There may come a point in life where you want to give your children or grandchildren a house. It could be because they are unable to get on the property ladder or because it helps minimise inheritance tax liabilities.

Whatever the reason, the UK’s property gifting rules need to be properly understood before moving forward. In this guide, we consider the advantages and disadvantages.

Under English law, inheritance tax (IHT) is payable on certain estates when the owner passes away. The estate is typically defined as all assets, such as property, financial savings and other physical positions.

Thresholds for inheritance tax

Different inheritance tax thresholds apply on estates. The nil-rate band is fixed at £325,000 per person and has been frozen until at least 2030. Tax is only payable on the excess part of the estate.

The residence nil-rate band applies when an estate includes the primary residence. If this is passed to children or grandchildren, it includes an extra £175,000 tax-free allowance – meaning the total tax-free threshold stands at £500,000 if you are a single person.

Then, there is the married or civil partner exemption. This allows spouses or civil partners to transfer assets tax-free, including up to £1 million designated to children or grandchildren.

Sound straightforward? Not so fast – there are different points to consider.

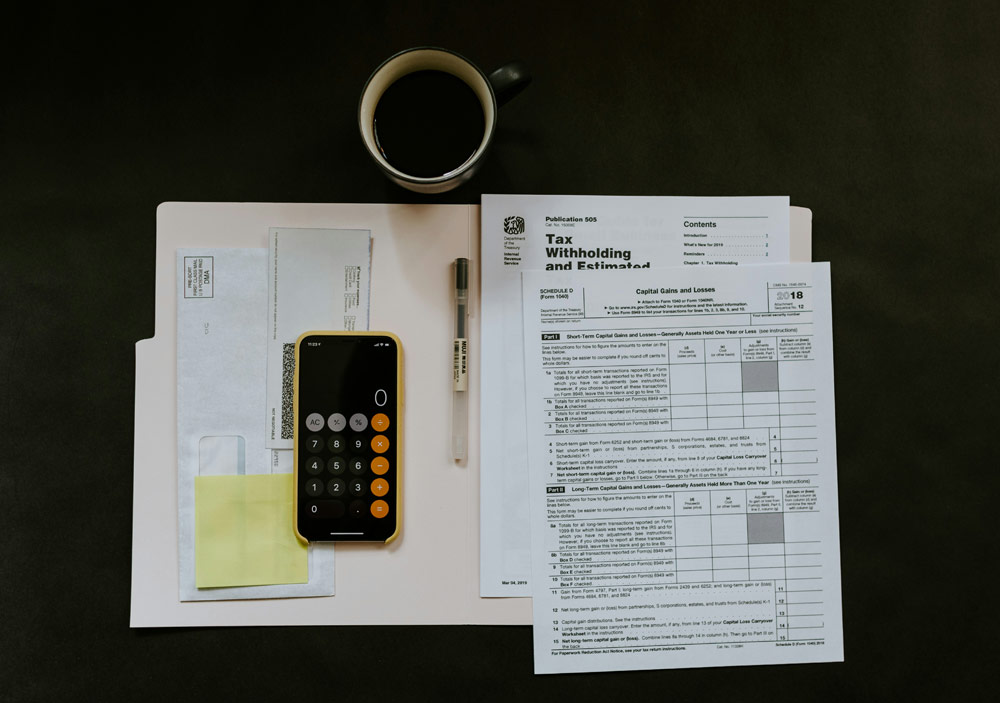

Gifts and their tax consequences

Firstly, you need to be aware of the seven-year rule. This states that people are entitled to a capped tax-free gift allowance not exceeding £3,000 per year, as well as any other allowances that are not hit by IHT.

Other higher value gifts are classed as a ‘potentially exempt transfer’. People living for seven years after transferring asset ownership will see them removed from an estate for IHT purposes. However, the estate of someone who passes away during that time period will be subject to a sliding scale ranging from zero to 40%.

Where it gets more complicated is if you decide to live in a property after transferring it to a son or daughter. Unless you reach an agreement to pay market rent, it may still be classed as ‘a reservation of benefit’ and therefore part of the estate, even though it has been legally gifted. Some parents may instead opt to partially gift a property under a shared ownership agreement; however, this will still be subject to tax.

Should the property have a mortgage, the recipient would need to satisfy affordability checks, while stamp duty might also be imposed. If you act as a guarantor, that would smooth the mortgage transfer – albeit leaving you liable in the event of non-payment.

Some parents may be wondering if Capital Gains Tax (CGT) would be payable. The answer is no if it is your primary residence; however, it is applicable on second homes or investment properties. For residential properties, CGT is charged on residential properties at a rate of up to 24%. Note that the nil-rate band of £175,000 applies to the main residence and not second properties.

A few people may consider gifts to be a way of avoiding care fees in later life, but local authorities are wise to this, and could instead claim costs from the recipient.

What process is involved in transferring ownership?

In order to legally gift assets, legal documents known as a Transfer of Equity or Deed of Gift need to be formalised in order to change ownership, while notifying the Land Registry and ensuring tax compliance. It is possible to reverse a gift if you change your mind or if the recipient’s circumstances change, but the process can be difficult and incur costly legal fees.

A ‘child’ who enters financial difficulties, due to say a divorce or bankruptcy, may find their new assets at risk. This is where legal protection, in the form of trusts, can be useful in averting such headaches. Indeed, trusts are one method of transferring property without paying IHT, and reliably offer tax perks and property protection. They can, however, be expensive and complicated to set up.

Gifting property has many pros and cons – both during your lifetime and in your will. It is, therefore, important to get professional advice. If you are estate planning in Cheshire, call us at Hartey Wealth Management to set up a consultation.